The last time the U.S. housing market hit a reset button was in 2008. Back then, it was homeowners and their mortgages that set off the chain reaction. This time, the pressure is coming from commercial real estate—especially apartments. For investors who are sitting in cash, the next couple of years could bring the best chance in over a decade to buy rental properties at a discount.

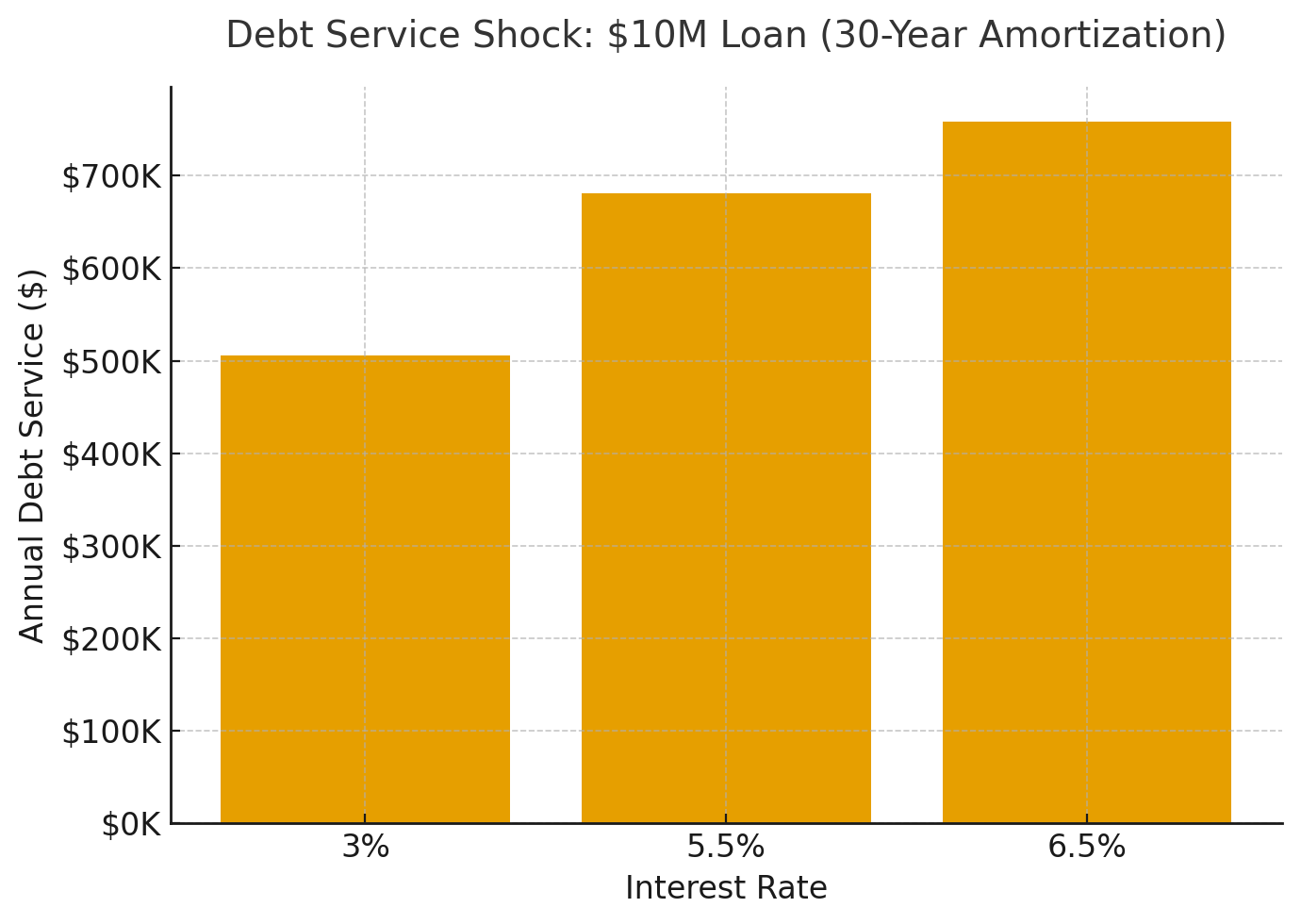

A wave of commercial property loans is about to come due. Nearly one trillion dollars in mortgages will mature in 2025 alone, with close to two trillion by 2027. Many of these loans were written during the low-interest-rate years, when borrowing at three percent was common. Today, that same loan would cost more than five and a half to six percent. On a $10 million loan, the annual debt payments would jump by almost half. For many owners, the math simply won’t work anymore.

When landlords can’t refinance, they face hard choices: put in more of their own cash, beg their bank for an extension, or sell. That pressure is already showing up in certain markets. Big Sun Belt cities such as Austin, Phoenix, San Antonio, and Charlotte built more apartments than they can fill right now, leading to rent cuts and giveaways to attract tenants. Older, rent-regulated buildings in New York are struggling under the weight of higher taxes and insurance. And nationally, delinquency rates on commercial mortgage bonds have risen for six straight months.

Despite this stress, the sky isn’t falling everywhere. On average, apartment prices have flattened after two years of decline, and some markets are even showing early signs of stability. Rent growth has cooled but remains positive in many areas, and demand is still strong. Millennials who can’t afford to buy homes and Gen Z renters entering the workforce need apartments. By 2026, when new construction slows, rental demand is expected to catch up again.

This is why apartments—and mobile home communities—stand out compared to other property types. Office buildings are still struggling to fill space after the pandemic, and retail faces long-term headwinds. But apartments and manufactured housing have history on their side: people need a place to live, even in a recession. Manufactured housing, in particular, has maintained very high occupancy and steady rent growth, even in tough markets.

So when will the buying window open? The most realistic timing is late 2025 into 2026. That’s when the bulk of low-interest loans written in 2020 through 2022 will mature, and lenders will run out of patience with “extend and pretend” deals. Banks and debt funds will need to clear bad loans off their books, and the discounts will start to appear. Some properties may change hands at 10–25 percent below their peak pricing from just a few years ago.

For investors, the message is clear: keep your powder dry. Cash on hand will be king in the coming cycle. Those ready with partners, financing relationships, and a clear investment strategy will have a chance to step in when others are forced to sell.

This isn’t 2008 all over again. The distress will be uneven and selective. But for apartments and mobile home parks, the next reset could be a rare opportunity to build wealth for the next decade.

Now is the time to prepare. Line up your team, refine your investment criteria, and stay liquid. When the deals start to surface, they won’t wait around.

👉 Join our investor list today to get updates on upcoming opportunities and market insights. Don’t watch this cycle from the sidelines.